Economist Chris Richardson believes that housing affordability will be a major issue at the next Federal Election.

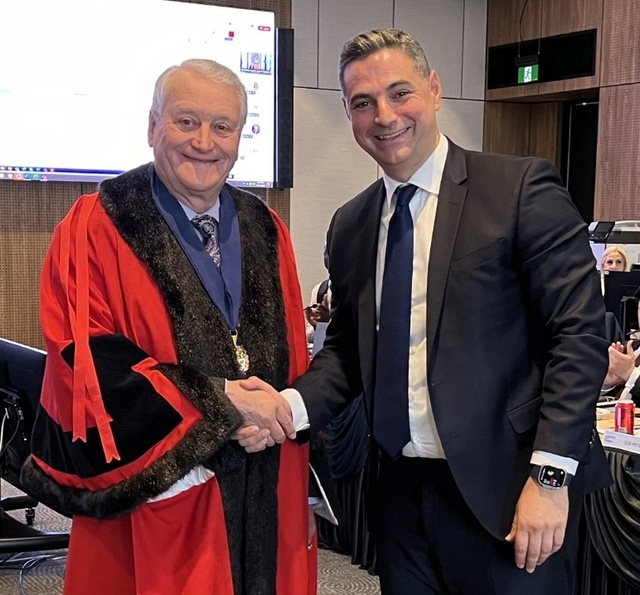

Speaking at the Local Government Association of Queensland annual conference, he said that from families to politicians, reduced housing affordability is a major concern.

In 1996 the cost of an average house was five times the average wage, but in just seven years, by 2003 this had doubled to be

10 times the average wage.

“Fewer people have paid off their mortgages, which is surprising given our ageing population,” Chris Richardson said.

“The trend is clear that for many people they will continue to pay off their homes well into retirement as a result of higher prices and going into greater debt.”

He said that increased demand with rising wages and reduced unemployment is one factor for reduced affordability, but much of the media is promoting the notion that it is the supply side with State and Local Governments loading up costs (stamp duty and development charges), as well as not doing enough to facilitate additional new land releases.

“But prices are high throughout cities, not just in new areas,” Chris Richardson said. “Not only have house prices leapt but all assets have increased, such as shares and commercial property.

“The key driver of this is the cheaper cost of borrowing – namely interest rates are low so people are quite prepared to bid up the price of houses. Therefore it is much more the case of demand rather than supply being the driver of reduced affordability.”

He said that one solution is governments improving rail and road transport to improve the location value of regional centres.

“Other options are doubling interest rates, cutting the first home owners grants, increasing capital gains tax and applying this to the family homes, all of which few governments would ever contemplate.