Wollongong City Council will urge the Department of Local Government to introduce mandatory credit assessments for medium and large Councils following their recent achievement of an AA+ credit rating. The rating was awarded to Council by international financial specialists and analysts, Standard and Poors’ and is the second highest available rating on their credit scale.

The rating is in recognition of Council’s efforts to maintain a strong balance sheet, strong cash flows and a minimum level of debt while retaining sufficient reserves to meet future liabilities.

Council’s Chief Financial Officer, Stephen Payne, said the acknowledgment came at a time when Council was looking at ways to address future potential budget shortfalls. The rating added confidence that Council could, if it chose to do so, take on moderate amounts of debt and still maintain a healthy financial outlook and the premium rating.

“Standard and Poor’s have acknowledged that although we face some challenges concerning our liabilities in terms of asset and infrastructure maintenance, Council is currently in a strong position,” Stephen Payne said. “It recognises the strong position we have placed ourselves in, in terms of our ability to cover our debt obligations which will be important as we identify ways to fund our stated commitment to infrastructure upgrades.

“A sense of transparency and a degree of confidence is also instilled in the community who are able to see that their Council is managing public funds appropriately. This confidence will be translated into the continuation of delivery of quality services and facilities which meet ratepayer expectations without placing Council in an untenable position in terms of financing its operational and capital programs into the future.”

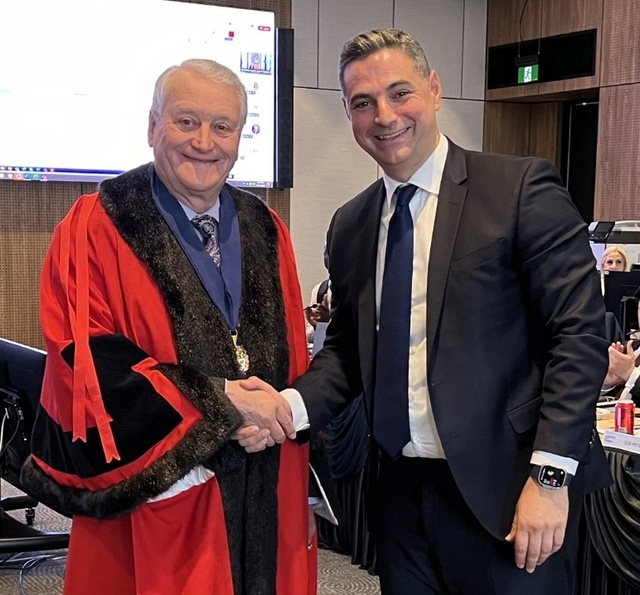

Wollongong General Manager, Rod Oxley, welcomed the rating as a reflection of strong fiscal management over recent years and the responsible attitude assumed by the Council on a range of financial issues.

“Council is now undergoing a program of cost reductions to further improve key ratios of the organisation,” he said. “We now sit with other large Councils including Sydney, Melbourne, Brisbane and Auckland as having undertaken the credit rating exercise.

“Wollongong’s new credit rating will hold a great deal of credibility with financial and business partners when the need to source funding for essential community projects arises. Investors and banks want to know they are dealing with organisations which can demonstrate stability and good fiscal management so that they can have confidence in their loaning and investment of funds.”

For further information contact Stephen Payne on (02) 4227 7286.