With its annual National Asset Management Conference timed to commence the day after the Federal Budget, Municipal Association of Victoria (MAV) President, Councillor Dick Gross, said there was plenty of good news for Councils. However, he added that Local Government is currently being seen in a contradictory light – worthy of support, as evidenced by the budget, but at the same time ready for reform – and at the heart of this is asset management.

He said the budget announcement of a huge boost and extension of the direct funding to Councils through the Roads to Recovery Program, the Blackspot Program and AusLink is vindication that Local Government’s involvement in these programs to date is seen as both cost effective and creditable.

“At the same time, we have the recently announced huge project of reform in Queensland – similar to that which occurred in Victoria in the mid 1990s,” Councillor Gross said.

He said a similar amalgamation process is taking place in the Northern Territory and could possible follow in other States.

“The PricewaterhouseCoopers report delivered at the Australian Local Government Association’s National Congress last year was received in an eerie silence,” Councillor Gross said. “I believe this and other recent sustainability reports precipitated the reform process in Queensland.

“We have to show that we are prepared to embrace change and we will contribute. If we want the Federal Government to give us access to a growth tax we must contribute ourselves. Internal reform of our operations will be rewarded with more money for Local Government, particularly for infrastructure renewal. We cannot keep going with under repair and non renewal of our assets.”

MAV CEO, Rob Spence, told delegates that the association has been collecting infrastructure data since 1998.

“This has been very useful in building strategies with our member Councils and

dealing with the other spheres of government,” Rob Spence said. “We know that across Victoria, Councils are spending 50 per cent on renewal and 50 per cent on new capital items. But some Councils are still spending all on new items.”

He said that the effect of this is ‘loading up’ for the future by not addressing what these Councils are already sitting on.

“The disconnect between finance areas and asset management teams within many Councils continues to be a problem,” Rob Spence said.

As part of its National Asset Management Strategy (NAMS), the Institute of Public Works Engineering Australia (IPWEA) is developing new national guidelines for financial management of infrastructure.

Chair of IPWEA – NAMS, Peter Way, described Local Government as big business.

“With an expenditure of $20 billion per annum or two per cent of GDP, some 160,000 employees, responsibility for $150 billion of assets, consuming assets at a rate of $3 billion per year and depreciation expenses often exceeding 25 per cent of expenditure, Local Government is more capital intensive than the private sector and the other spheres of government,” Peter Way said. “Various reports have identified a number of Councils with significant operating deficits, renewal expenditure being deferred and questions hanging over them regarding their longterm financial sustainability.”

He said that the Queensland Government had drawn on the PricewaterhouseCoopers report in its move on this State’s 157 Councils, which will see widespread amalgamations in place by August this year.

To assist Councils in their asset management programs, IPWEA has released a DVD titled, ‘Sustainable Communities’. This covers stewardship by elected members; managing existing as well as new assets; and long term financial planning.

“There is still too few resources being applied to the asset management task,” Peter Way said. “The emphasis is on the new, leading to Councils not looking after what they already have.”

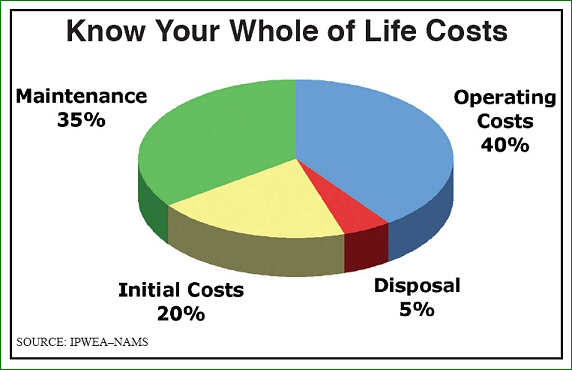

He said whole of life costings need to be considered for all new assets. On average, lifecycle costs for new capital items are as follows:

- initial costs – 20 per cent

- operating costs – 40 per cent

- maintenance – 35 per cent

- disposal – five per cent.

“Sustainability studies identified weaknesses in financial reporting,” Peter Way said. “Inconsistency in approaches and application of standards has led to these new national guidelines.It is an exciting project with accountants, auditors and engineers working together to produce the Australian Infrastructure Financial Management Guidelines.”

Position papers can be viewed at www.nams.au.com, with feedback encouraged from across the sector. The guidelines are expected to be released by the end of this year.