With Australian carbon price legislation creeping steadily closer, the confusion in the community continues to build. As Chartered Accountants we are at the coal face of this confusion and we are regularly asked to provide proactive guidance helping our clients transform a significant business risk into an opportunity.

Much of of the confusion stems from a lack of understanding of the difference between “carbon tax” and “carbon credits”. Here we offer some insight into the key differences between the carbon tax and carbon credits.

Proposed price on carbon

There is confusion in the business community around the coming “carbon tax,” its implications, and how it relates or compares to “voluntary action,” such as carbon credits.

The Australian Government plans to put a price on carbon emissions starting from 1 July 2012, before moving to a market based (or emissions trading) scheme in three to five years.

The Government has stated that initially carbon will be priced between $10 and $40 a tonne, but most experts believe the starting price will be between $20 and $40 a tonne. This price will be placed on the heavy emitters of carbon, such as power generation, mines, smelters and so forth.

Emissions from energy, transport, industrial processes, fugitive emissions (such as methane leaking from coal mines), and emissions from non legacy waste (such as methane leaking from landfills) will be included for those heavy emitters.

The Government is designing the carbon price scheme to encourage more carbon efficient processes across all industries.

As the price of carbon increases, greener options such as renewables will become more viable with shorter pay back periods. The Government is also planning an assistance package for those who need help to adjust, such as trade exposed businesses. Some costs incurred by manufacturers will be passed down the supply chain to businesses and consumers, so there will be a compensation package for low to middle income earners to alleviate cost of living increases.

Voluntary action (that is carbon credits)

Voluntary action is when an organisation chooses to voluntarily offset all or some of its Greenhouse Gas (GHG) emissions. This is achieved through the purchase and retirement of certified carbon credits, or a mix of accredited GreenPower and carbon credits.

This action is completely independent of the Government’s price on carbon and provides businesses that are not directly covered by the legislation the opportunity to reduce their carbon footprint.

Some reasons for undertaking voluntary action include:

- good corporate citizenship – such as triple bottom line reporting or Corporate Social Responsibility (CSR).

- supply chain pressure – more and more customers expect green credentials from their suppliers. It is now common place to find an entire section of a tender document dedicated to this important subject, and voluntary action provides a much needed competitive edge.

- staff attraction and retention – attracting and retaining quality staff is a challenge for most businesses. Good green policies that engage employees assist this challenge.

- Financial – many environmental initiatives result in realised efficiencies. In most cases these translate into cost savings through reduced expenses on items such as electricity, stationery or other consumables.

Climate Change poses both challenges and opportunities for individuals, governments, organisations and businesses alike.

In particular the identification, measurement and reporting of the risks associated with climate change are becoming commonplace for businesses as the Government introduces specific policies such as the proposed carbon tax to address climate change.

Walker Wayland Climate Change is a division of the members of Walker Wayland Australasia, a progressive network of accountancy firms with office locations in major capital cities and regional areas across Australia and New Zealand.

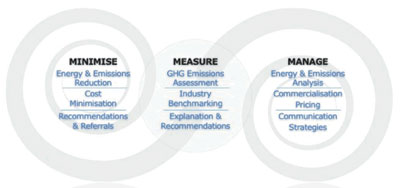

Through our strategic alliance with Pangolin Associates we can offer solutions to your carbon management needs including:

- greenhouse gas emission assessments including NGER compliance and auditing

- carbon risk and opportunities analysis

- education services for management and staff

- carbon commercialisation planning

- energy audits.

We tailor our three step strategy to carbon management to suit the specific and individual needs of each organisation.

If you would like more information or need assistance with managing your organisation’s carbon risks and opportunities, please visit our website www.wwclimatechange.com.au and contact your closest Walker Wayland Climate Change office.

*Copy supplied by Walker Wayland Australasia