A long term financial plan has begun to gain results for Mount Alexander Shire in Victoria. Mount Alexander Shire Council first adopted a Long Term Financial Plan (LTFP) in 2003 setting guiding principles and strategies for it to improve its financial sustainability over a 15 year timeframe.

Director Corporate Support Lucy Roffey said the financial challenges facing Council at that time were recurring operating deficits, increasing cost pressures, a decline in other income and borrowings of nearly $5 million.

At that time, Mount Alexander Shire rates per capita in 2002/03 were second lowest for other small rural councils in Victoria.

At the time it was calculated that rate increases of over 8.5 per cent per annum were required for Council to reach a break even position over five years.

The LTFP in 2003 aimed to:

- achieve a break even annual operating result

- minimise interest bearing liabilities, aiming to reduce borrowings to acceptable levels within six years

- increase general reserve to $1 million minimum

- maintain growth in net assets

- reduce the gap between the annual Capital Works Program and the annual asset depreciation charge each year.

The second LTFP was developed in 2007 after a number of improvements were made in addressing the issues identified in the 2003 plan.

The objectives of the 2007 plan aimed to address ongoing operating deficits and infrastructure renewal.

The LTFP was updated again in 2010 and building on the strong improvements made in Council’s financial sustainability, provision was made in the plan to address the need to upgrade Council’s ageing infrastructure, and in particular buildings and recreation facilities.

Lucy Roffey said the rebalancing of the rates has been the major initiative to improve Council’s financial sustainability.

“The rate income is now sufficient to enable our community infrastructure to be upgraded to meet the community’s needs,” she said.

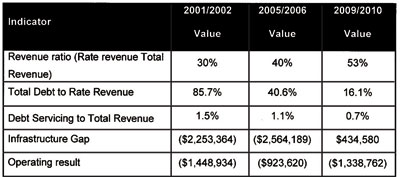

The LTFP has been used since 2003 to set underlying financial targets during the Annual Budget process including rate rises. The above table shows the improvements achieved in a number of key financial indicators.

In particular, Council has significantly improved its rating effort, has reduced its debt to prudent levels and addressed the infrastructure gap.

Achieving operating surpluses continues to be a challenge with the timing of receipt and expenditure of grants impacting results from year to year (for example 2008/09 a surplus of $2.2 million was recorded followed by a deficit of $1.3 million in 2009/10).

Lucy Roffey said it has been Council’s fiscal discipline since 2003 that is the key to the success of the strategy.

“We’ve all been in it together since day one and the strategy is beginning to bear fruit now, enabling investments in our sporting facilities and environmental programs,” she said.