The dream of home ownership is finally within reach for the predominantly Indigenous residents of two of Queensland’s remotest towns after an ambitious project driven by Burke Shire Council received Ministerial approval on 10 September.

Home ownership in the Gulf Country towns of Burketown and Gregory, approximately 500 kilometres north of Mount Isa, has long been on the agenda for the community, however, requests by banks for deposits of up to 60 percent due to their geographic isolation have thwarted previous attempts to make it a reality.

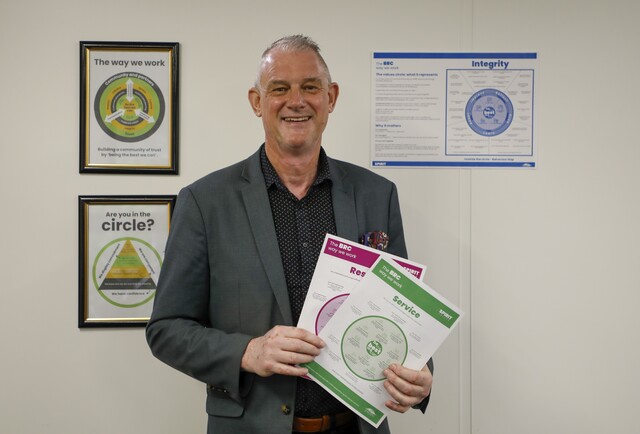

Council, the largest property holder in the local government area, plans to sell up to 21 of its properties as part of an innovative divestment of assets, which, according to Chief Executive Officer, Clare Keenan, would have tremendous benefits to both Indigenous residents and ratepayers.

“The cost of repairs and maintenance to this Council housing, much of which is already occupied by staff who want to experience home ownership, far exceeds rental income in direct costs, and significantly more if the administration cost of property management is factored in.

“Home ownership is such a fundamental part of Australian life, yet Indigenous staff and residents up here have been told point blank for years that they needed absolutely ridiculous deposits that banks would never ask customers in less remote parts of the country to come up with.

“In addition to the positive social, inter-generational economic and community benefits of facilitating local home ownership, divesting of these properties will allow Council to deliver more value to ratepayers and allow us to build new houses, which are so badly needed to attract staff.”

Council’s Community Services and Compliance Team Leader, Madison Marshall, rents one of the properties with her sister and fellow employee, Jordan. She and said the project green light was exciting and meant they were now able to look at home ownership as a genuine proposition.

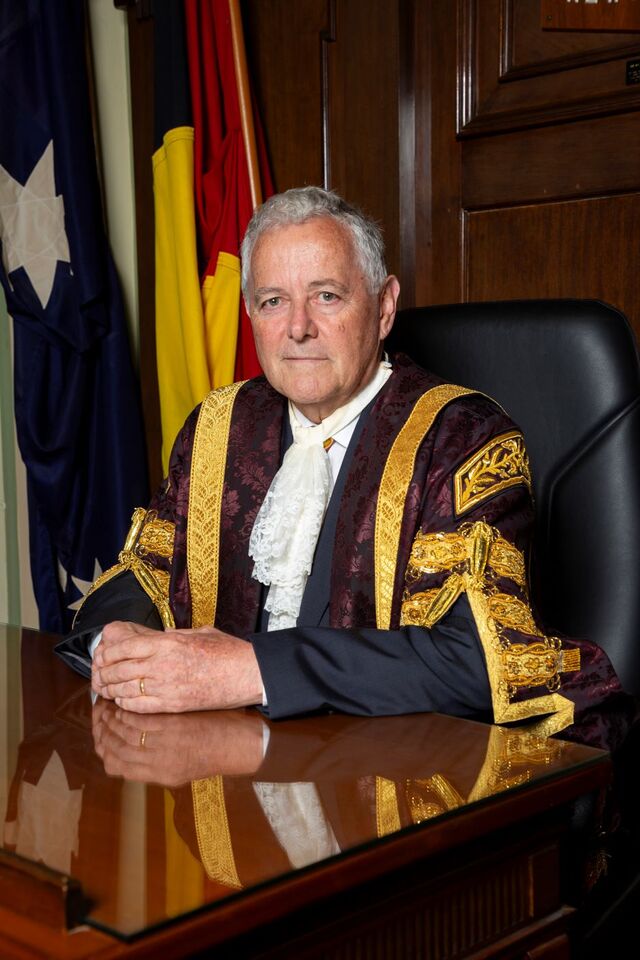

Mayor Ernie Camp praised Minister for Local Government Stirling Hinchliffe for providing the exemption required for Council to divest the properties, and Westpac for “coming to the table to come up with an equitable solution to remote mortgages”.

“This is just a brilliant result for our community, and I thank the Minister and Westpac for taking a big-picture approach to finding a solution to the problem of remote lending that has for too long been discriminating against residents in remote areas such as Burke Shire, many of whom are Indigenous and have long thought owning their own home was nothing more than a pipe dream,” he said.

Burke Shire Council is proud to have facilitated this milestone project and would encourage other financial institutions to follow Westpac’s lead and come on board to enable equity in home ownership for Australians, regardless of their postcode.

“When this project is complete, we believe that Burketown may have the greatest proportion of Aboriginal-owned freehold residential land of any Australian town. We are keen to showcase it as a working multi-cultural model that can be rolled out across the rest of the country.”